A strong coliving business model is the core to any successful shared living organisation. But how can you get there as a coliving, investor, developer and/or operator? This short guide looks into the ‘coliving business model’ and explores different coliving typologies, property models, challenges and best practices for achieving financial sustainability.

Also, tune in to Coliving Conversations (Season 1) for more on models and scaling.

Ready? Let’s explore.

Coliving typologies and models

Developing a ‘Coliving Business Model’ requires one to have a strong understanding of a variety of factors including location, coliving typologies, target audience, development strategies and much more.

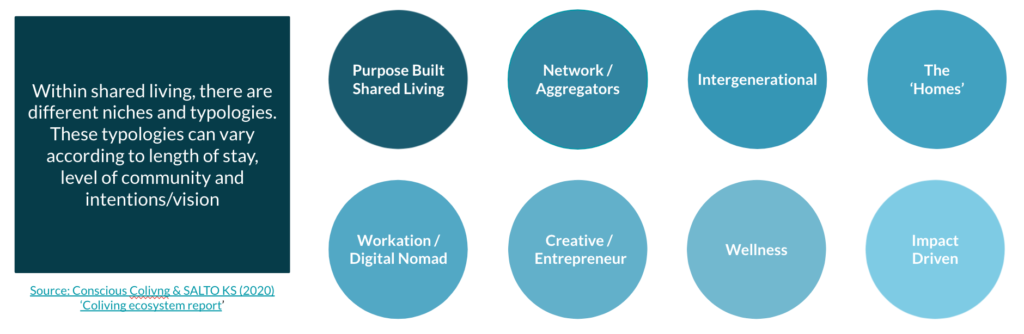

With our partners at SALTO Systems and Coliving Insights, we have conducted and contributed to research including the Coliving Ecosystem Report and Coliving Insights No.1, Exploring coliving as an innovative housing solution. Based on this research and our own internal R&D, we have identified different typologies of shared living models:

These typologies range from renovated townhouses to large scale purpose-built shared living models, and some even have very niche audiences such as the wellness and intergenerational models. To learn more about these models you can download the Coliving Ecosystem Report.

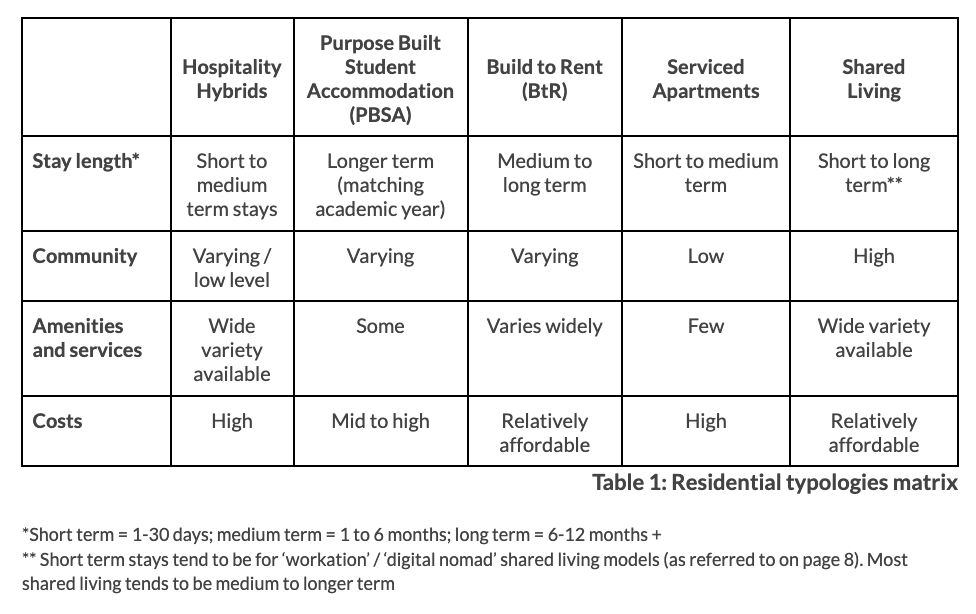

Coliving also has similarities with other residential real estate asset classes, including hospitality, purpose-built student accommodation (PBSA), build to rent (BTR) and serviced apartments. The table below illustrates how shared living distinguishes itself from these other residential typologies.

Within these typologies, one must also look into the different property and investment models involved.

Asset-heavy or asset-light business models?

Some operators go with an asset-heavy / vertically integrated model, where they own (or co-invest), develop and operate coliving schemes all in-house. This is a high-risk, high-autonomy but high-returns model.

In comparison, there is the asset-light model, where operators lease spaces from property developers and owners, and are involved at varying degrees in the designing, operating and marketing of the coliving spaces under their brands.

In the asset-light model, there are two main approaches which include management agreements and master lease contracts. You can read more about these in this article from Common, about why they have transitioned mostly into management agreements.

For asset-light companies that focus solely on property management, scaling quickly is an important aspect of the business model. The margins for property management companies are oftentimes quite thin (between 4-12% of total rent) and the process of managing a property is labor intensive. Thus, in order to bring in enough revenue to cover the day-to-day management of properties (leasing, maintenance, cleaning, etc.) AND pay for company overhead (sales, HR, leadership team, etc.), the number of beds under management needs to be high to break even.

The data in Coliving Insights No.1 identifies these different property models, and shows that many operators predominantly rely on retrofitting existing structures and operating them under management contracts, while only a minority of the reviewed businesses have integrated models with full stack development capabilities and elements of real estate ownership. To learn more about these property models and dive into a SWOT analysis of 25+ coliving operators, you can download Coliving Insights No.1 now.

Challenges of coliving business models

With recent administrations, bankruptcies, mergers and acquisitions in the past year, the coliving market is still in consolidation phase and the best practices of how to operate a coliving brand at scale depend on a range of factors, typologies and externalities. The recent activity in the market shows that coliving operators are still trying to understand the best (or several best) ways to manage their coliving business. Below we identify a few of the main challenges when it comes to developing a strong coliving business model:

Challenge #1: Obtaining planning approvals

One of the biggest influences on the coliving business model are local policies, especially in major urban locations. Municipalities tend to misunderstand coliving as a housing typology and it is often categorised either as traditional housing, hotels, BTR / multifamily and/or mixed-use developments that include elements of both commercial and office real estate (sometimes referred to as ‘sui generis’).

This grey area makes it difficult for some coliving developers and operators to achieve planning approvals, and leaves a big opportunity for more bespoke coliving policies to emerge. As an example, see Policy H18 in the London Plan for Large-scale purpose-built shared living (LSPBSL) and the recent London Plan Guidance on this policy.

Challenge #2: Financial viability

As mentioned above, the margins of operating coliving developments can be quite thin and the process of managing a property is very labor intensive. Add in the extra overheads (e.g. marketing, cleaning, sales, design, etc.), and achieving financial sustainability can pretty quickly become quite complex.

With this in mind, many coliving operators resort to a ‘high-growth’ model to acquire and operate a high number of beds in order to achieve financial success and appropriate margins. This high-growth model has yet to be completely proven, as some experts say that this model results in a lack of authentic community experience as well as too high of risk and burden on the operator to operate existing locations while delivering on aggressive expansion plans (some say this type of approach – and the costs of the pandemic – has led to the recent administration of coliving investor, developer and operator, The Collective). Put another way, if a coliving operator is only focused on adding as many beds under management as possible, they may be incentivized to cut corners in the name of growth and lose sight of providing an excellent living experience for their members.

That said, because of their densification and mixed-used nature, the financials behind coliving assets can result in increased revenues, marginally increased operational costs and ultimately an increase in NOI (calculated as total rents minus operating expenses) of up to 10-30%. For asset-heavy coliving companies that own coliving buildings, this increase in NOI is the most crucial part of the business model. Since coliving is still an emerging asset class, investors will want to see a higher potential return in order to compensate for the perceived increase in risk for investing in a relatively unproven real estate strategy.To learn more about how coliving is valued you can refer to this CBRE article as well as our ‘Coliving Investment’ page.

Challenge #3: Multi-stakeholder engagement

Engaging the variety of stakeholders in both your B2C and B2B communities requires a lot of strategic planning and multi-stakeholder coordination. Stakeholder-driven shared living is about creating shared living communities that extend their positive impact beyond their inner circles of shareholders and users to all of their B2B and B2C communities and stakeholders, including residents, staff, management teams, suppliers, local communities, city planners, public officials, shareholders and beyond. It is about aligning your business strategies with global ESG, social value and sustainability goals.

This requires a holistic strategic and brand identity that goes from ideation and concept stages all the way through to design, planning, development and operations. It requires branding and marketing strategies that foster authentic shared living communities. It requires buy-in from partners, planners and potential and current residents, amongst many others. We can not deliver value these days without thinking holistically and consciously about how our products and business activities influence and impact (both negatively and positively) the multi-stakeholder ecosystems we are all a part of.

Challenge #4: Proving the value of community

The top three selling points for coliving are community, convenience and cost, but the biggest USP for coliving is, without a doubt, community. Residents will vote with their pockets and when one coliving community is providing a timeless and unforgettable experience, word of mouth will bring more and more residents from one coliving brand to another.

However, finding metrics that prove what is behind a thriving community is difficult. In addition to traditional net promoter scores (NPS) and retention and referral rates, many operators are not left with many options on how to get a pulse of their community experience.

Conscious Coliving have conducted internal R&D and keynotes on ‘How to foster a thriving community’, where we explore the benefits of a strong community experience on both members and the coliving business model. We have also developed The Community Facilitation Handbook, which identifies key aspects of user and community experience (UCX) strategies.

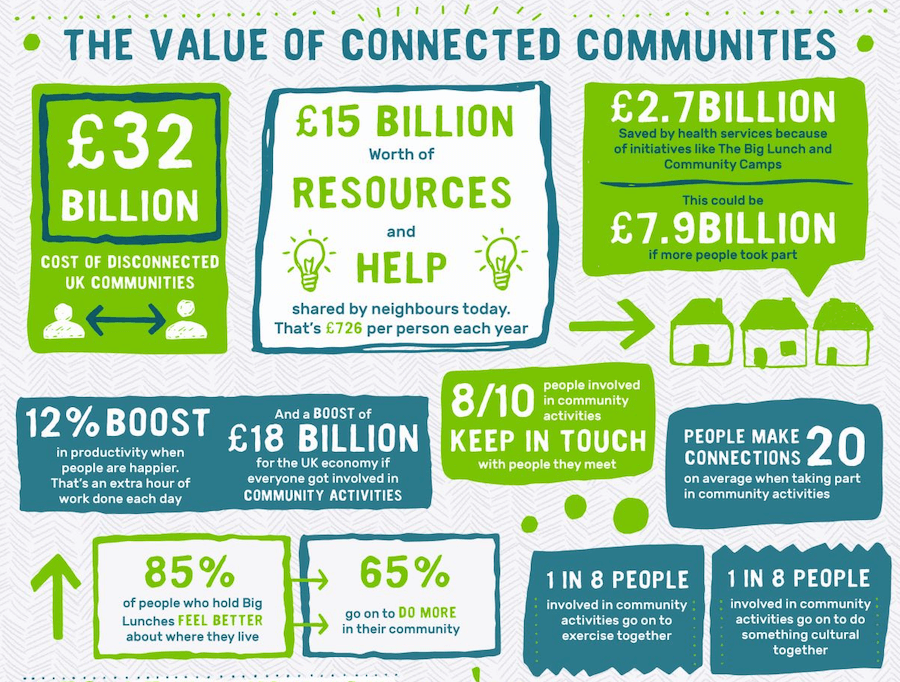

Being able to measure this kind of value is important. To understand the cost of connected (and inversely, disconnected) communities, you can look into the research from The Eden Project and the UK’s Centre for Economics and Business Research (Cebr), which looks into the value and cost of strong communities.

You can also watch this video made for The Class Conference 2021, which highlights key business benefits of investing in community including longer retention rates, cost savings, and brand loyalty.

You can learn more in the Community Facilitation Handbook. And you can also explore how we can support you to make your community thrive.

Challenge #5: Understanding corporate sustainability

ESG (environmental, social, governance), social value, impact investing, sustainability strategies and the likes are on the tip of the tongue of many businesses, regardless of the industry. The pandemic, accelerating climate-change induced natural disasters and social crises have made corporate sustainability an even hotter topic these days. This article in Harvard Business Review from December 2021 talks about how 2021 was the year where sustainable business practices went mainstream.

But these terms can be confusing and with the lack of standardized sustainability certifications and assessments (especially within the real estate sector), it can be challenging to adopt these kinds of strategies. Often, real estate companies – especially shared living startups – need to prioritize getting ‘heads in beds’ before even thinking about having a corporate sustainability strategy. What’s more, is if their investors are not requiring this from them then they have even less of an incentive to do so.

Proving social value (social, environmental and economic impact) can be a difficult and nuanced process. This is why Conscious Coliving are working on how to measure and report on the social value of coliving – with our Coliving Impact Framework – in order to support operators in proving to investors, colivers and policy makers the social return on investment (SROI) of a strong coliving experience.

With change comes complexity as well as opportunity, and coliving brands have a chance to create innovative business models that are stakeholder-driven and that focus on people, planet, purpose and profit. As we like to say, doing good is good business!

The viability of the coliving business model

The coliving business model can therefore learn from – and inherently resembles – its close relatives in the hospitality, BTR, multifamily, student accomodation and serviced apartment sectors. A strong financial model requires coliving businesses to conduct in-depth property level forecasts – with outputs including annual cash flows, net operating income (NOI), internal rate of return (IRR), and other relevant real estate metrics – and strong sensitivity analyses, amongst other business considerations (e.g. measuring and reporting on your social, environmental and economic impact).

When compared to traditional living models such as urban apartments or single family homes, the coliving model achieves higher returns for investors through densification and offering a quality living experience at comparatively lower rents. US-based research has found that on average coliving provides renters with a 30% discount to gross housing costs of traditional housing options in the same area, which is the main reason why urban coliving rooms are in such high demand and operators oftentimes have 95%+ occupancy rates. To learn more about the USPs of the coliving model, you can watch this video from Claire Flurin, co-founder of Co-Liv and Head of R&D+Innovation at Keys AM, from the Co-Liv Summit 2021.

What has been the impact of the pandemic on the coliving business model?

As for the resilience of the coliving business model amidst the pandemic and other crises, experts believe that the model is resilient, with investor confidence remaining strong, and relatively high occupancy levels and healthy bookings being reported during the pandemic.

The sector was indeed tested by COVID-19, as Connor Moore, Associate at Nomos Group, writes:

While the pandemic has definitely constituted a vigorous and unprecedented test to the coliving model, I believe in the long-term these tough times during coliving’s infancy will help to create a leaner, more efficient industry model that will yield even better risk-adjusted financial returns for investors. The coliving operators that survive the challenges caused by the pandemic will emerge with stronger and more financially sound business models that rely on fundamentals rather than the magical valuation methodologies of the venture capital world to generate value for both their residents and their investors.

-Connor Moore, ‘Coliving Investment Thesis’, Coliving Insights No.4

Connor is not the only one with this perspective, and with the recent hardships from the pandemic and bankruptcies within the sector, coliving business models will undoubtedly evolve. To learn more about the viability and resistance of the living sector in general, you can also consult JLL’s Q4 2021 report on ‘Growth opportunities in living’.

Create and optimise your coliving business model

To better understand how to create and optimise your coliving business model, you can look into the resources included on the Coliving Research page.

Although these are high-level guides and resources for developing something that is quite complex, they provide good frameworks for the different elements involved in starting a coliving business. Once your business model and financial foundations are considered and evaluated, then you can start to think about the spatial design, visual identity, community and user experience and overall brand ethos and brand.

In this short guide we aim to provide you with additional resources and inspirations for how best to develop a sustainable coliving business model. With the pandemic still present, you may feel some hesitation over starting your coliving venture. However, this event has only emphasised the importance of our homes as a place of social connection. Plus, many operators are experiencing continued growth throughout all of these external challenges, with some crossing seas from the US to the UK with strong pipelines, and new brands emerging every month.

If you are looking for support on how to develop or enhance your shared living brand, we have a range of services and products to help you do so. If you are ever looking for support on any of these elements, feel free to reach out to our team and partners!

As a collective of researchers, urbanists, international development experts and real estate professionals, we empower the people and businesses driving the global coliving movement through research, consultancy, training, frameworks, coaching and more.

This guide has been co-authored for you by:

Matt is responsible for designing community experience and impact strategies and measuring the social value of coliving communities. Matt is also a founding member and current Head of Community of Co-Liv and has worked for The Collective on their Impact Team.

Penny is Director of Research & Sustainability at Conscious Coliving. She has an MSc in Social Research Methods, and her PhD explores how shared living may enable lowered environmental impacts. She has consulted on numerous shared living projects, specialising in impact strategy, concept, and community. Penny has presented at conferences including the Co-Liv Summit, the Urban Living Festival, BTR360 and more. She has also authored publications in The Developer, Coliving Insights Magazine, the book Urban Communal Living in Britain, as well as being interviewed by the BBC and the Guardian about shared living.

Connor Moore serves as the Head of Content at Co-Liv and works as an associate at Nomos Group, a merchant banking firm focused on investing and advising at the innovative frontier of real estate. Connor’s career in coliving began in 2019 during an MBA research project when he visited dozens of coliving operators around the world and launched a coliving research blog called Coliving Corner to document his findings. Over the past year Connor has worked closely with some of the largest coliving real estate companies in the world such as Six Peak Capital, presented coliving research at global conferences, and contributed several thought leadership pieces to leading coliving publications such as Coliving Insights.