There are many ways to improve the ESG performance of your property. A number of these measures are unique to the coliving experience. In this article with guest author Logan Nagel, Content Specialist at Spaceflow (one of the main partners for Coliving Conversations, Season 1), we discuss some of the most important factors to consider.

Coliving and ESG are Influencing Real Estate

As a subtype of multifamily (known as build-to-rent in the UK and Europe), coliving is the kind of property niche that crystallizes many of the most transformative trends and forces shaping the industry. Want to talk about how community matters to your property’s success? Or how tech can be a crucial part of establishing that community? Or how trends in remote work and travel are impacting leasing? Coliving is a laboratory like no other. Another of those hugely impactful trends affecting the real estate world as a whole is the rise of ESG considerations.

Regardless of whether you work with apartments, offices, retail spaces or warehouses, ESG is truly one of the most transformative forces impacting the industry today.

Coliving, with its emphasis on community and participation, presents a unique case for ESG measurement. All of the typical considerations conventional multifamily needs to examine are there, but coliving has additional opportunities to make truly big strides toward sustainability, equity, and good governance.

In this article we’ll give a brief primer into what ESG measurement is before sharing a number of critical ESG strategies coliving owners and managers should consider implementing at their properties. Finally, we’ll finish with a discussion of how Spaceflow’s tenant experience platform can help succeed in many of these strategies.

ESG Primer

All ESG means is ‘Environmental’, ‘Social’, and ‘Governance’. These are important categories of corporate responsibility and sustainability that broadly speaking serve to represent the ‘good’ that companies can do.

Increasingly, progress across the ESG categories are being demanded by consumers, investors, and governments. Companies that do well on ESG are not only better for people and planet but are less exposed to risks and shocks arising from each of these categories, such as surging oil prices.

ESG efforts are receiving support from a different sources. The EU has wide-ranging ESG requirements, for instance. And on the investment side, as of this year, ESG is central to the investment approach of 28 percent of global investors. And while it’s a statistic from the world of office real estate, properties certified with the sustainability-focused LEED certification see a 5.6 percent rent premium over non-certified properties, illustrating high demand amongst commercial tenants.

Below we outline what we mean by ‘Environmental’, ‘Social’ and ‘Governance’:

Environmental

The ‘Environment’ category might be the prototypical vertical average people think about when they imagine corporate responsibility. It relates to all the elements of business that impact the Earth, such as trash production, carbon emissions generation, or water use.

These factors play out across multiple levels: your firm, your portfolio, your properties, and then the actions of your renters themselves. Each one has an environmental element, as well as many opportunities to boost resilience and improve efficiency.

Social

The ‘Social’ factors in ESG relate to a company’s impacts in terms of things like labor, human rights, and equity. In real estate, this includes everything from the practices and policies of the construction company and contractors who build properties to the way that residents are treated to the working conditions of your maintenance staff.

The ‘Social’ category also includes geopolitical factors, such as exposure to things like global conflict, and on the flip side, what you are doing to avoid supporting countries or sub-national groups that have a history of human rights abuses.

Governance

The ‘Governance’ category of ESG relates to company structure, whistleblower protections, board considerations, and similar corporate considerations.

As Spaceflow explains in their white paper Strategies for Improving ESG Measurement in Apartments, available for free, the governance focus points laid out by the International Corporate Governance Network are:

- Board role and responsibilities

- Leadership and independence

- Composition and appointment

- Corporate culture

- Remuneration

- Risk oversight

- Corporate reporting

- Internal and external audit

- Shareholder rights

- Shareholder meetings

ESG Strategies for Coliving

Now that we’ve discussed the characteristics of ESG in general, we’ll dive into some of the unique ways coliving operators can ace their ESG efforts. These will all be strategies more or less unique to coliving. For a more general take on coliving ESG, check out our article Embedding Social, Environmental and Economic Impact in Coliving.

Enhancing coliving democratization

Coliving distinguishes itself from traditional multifamily primarily by its emphasis on shared spaces and community. Every community needs some form of leadership, whether it is as simple and devoluted as getting consensus before choosing what food to order or as structured as a government.

Your coliving property could benefit from enhanced democratization, specifically along the ‘Social’ and ‘Governance’ angles of ESG. This could be as light-hearted as making it easier for your residents to decide on a Saturday night movie, or as serious as setting up an anonymous and easily available ‘bad roommate’ contact channel. These things may seem to have little relation to ESG, but as simple and every day as they may be, they would represent big advances towards democratizing your building, and consequently acing the ‘S’ and ‘G’ pillars of ESG.

Enabling giving back

Going along with the coliving emphasis on community, you should do what you can to make it easier for your residents to give back to their community.

This could be as simple as hosting a donation drive once a year, but as a coliving property, you can take this to the next level. Why not build formal relationships with local community organizations and provide a simple way for your residents to volunteer with them?

To take that a step further, open up your volunteer opportunities (and other community events, for that matter) to both your coliving residents and your staff as well. This will help your residents see your company as the simple group of people it is, and potentially kick start a few friendships, as well.

Enable environmental efficiency

We’d be remiss to forget the E in ESG. Environmental efficiency is a critically important factor for any coliving property, and while many of your most impactful efforts will come from more general areas like sustainable construction, there are still some uniquely coliving things to consider as well.

Why not make it easier for your residents to live sustainable lives themselves? The community dynamic inherent to coliving means that it’s a lot more practical to arrange carpooling, shared grocery runs, or even a compost project than at traditional multifamily properties.

Make your property into a community center

Finally, you should consider making part of your property into a community center for local non-profit events. Depending on how large your property this may be easier or harder but particularly if you have a public lobby area, perhaps with an outdoor space or deck, or even just a couple of conference rooms, why not circulate to your community partners that your space is open for their approved events?

Perhaps a local organization needs a space for a leadership board meeting, or a tutoring event. Making your space available for their use would benefit the Social element of ESG while also casting your firm and property in a positive light to the community, potentially resulting in additional marketing success due to social media exposure and word of mouth.

How Spaceflow Helps

Spaceflow’s platform offers a number of functions and benefits that could help you put these coliving ESG strategies, as well as others, into motion.

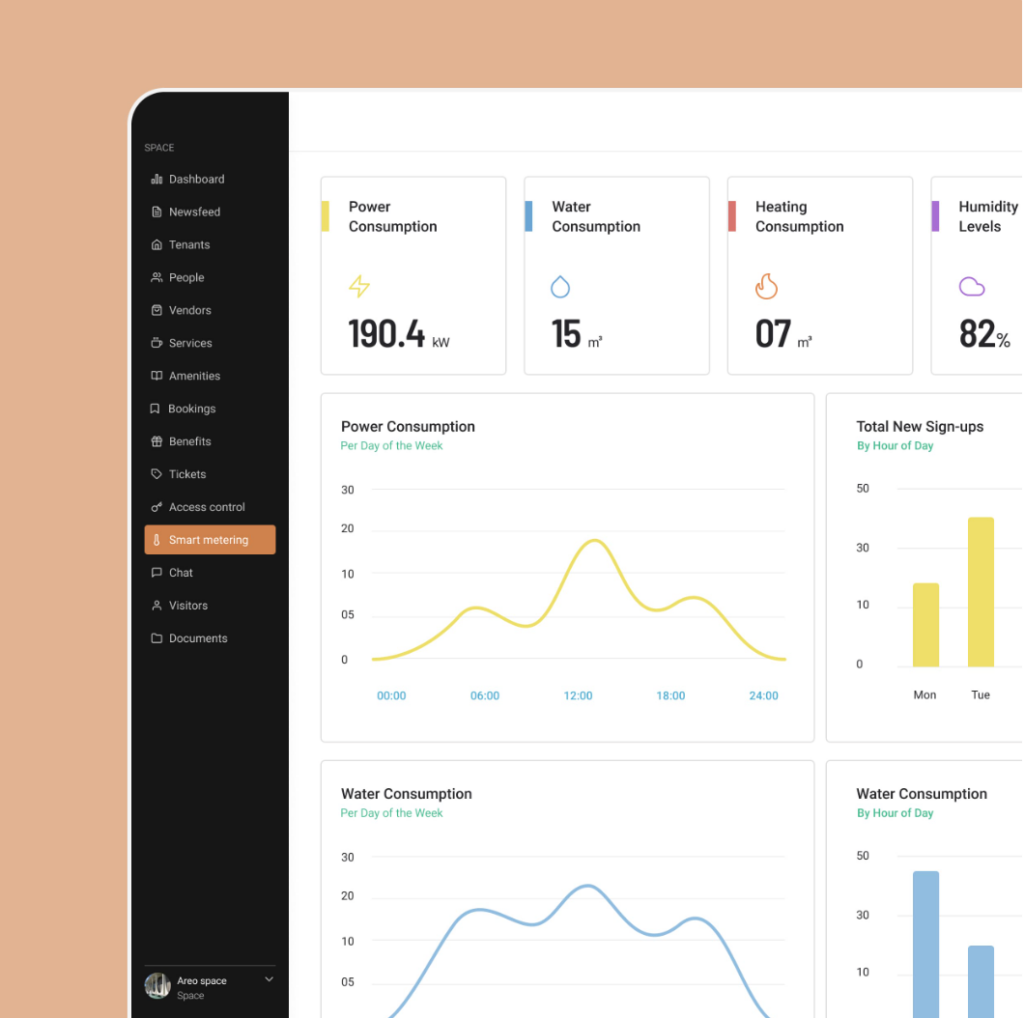

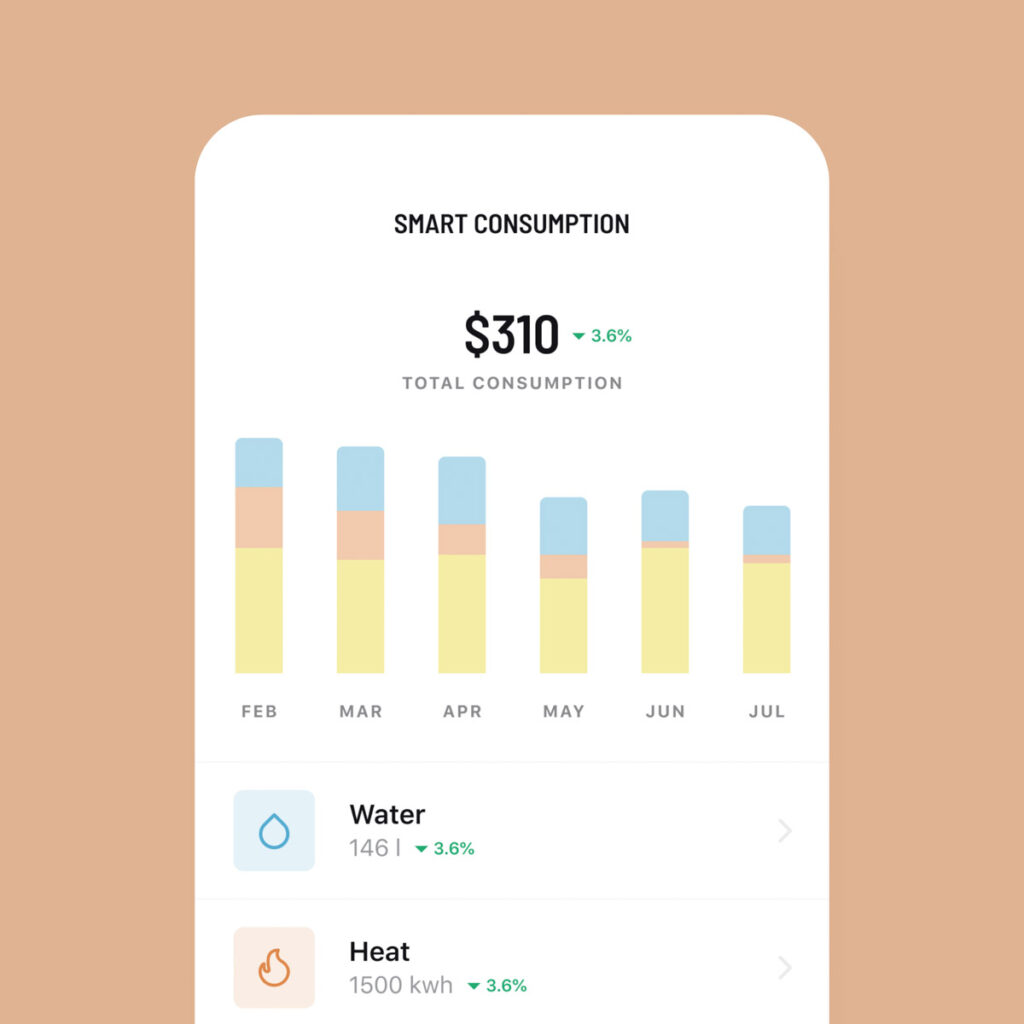

Dashboards & Smart Metering

Spaceflow’s dashboards make it easy to gain at-a-glance visualization into important operating details of your building such as energy and water consumption or emissions generation. Additionally, Spaceflow’s platform also provides dashboard analytics into figures like space use and visitor counts.

Communication Tools

Communication is at the heart of any coliving community. Tying into strategies listed above like democratization and enabling environmental efficiency, Spaceflow’s communication tools make it easier for your residents to connect with your staff and one another.

Want to help your residents schedule a weekly shopping run or decide how to split the costs for a shared coffee subscription? Spaceflow’s group messaging, polling, and other communication features are good ways to do it.

Access control and visitor management

Spaceflow’s access control and visitor management features include touchless entry to your building, measurement tools to keep track of space usage, and visitor access provisioning and information sharing.

These are crucial features if you’re interested in using your space for community events as we recommended above. You certainly don’t want just anyone meandering through your building. Instead, invite selected guests who RSVP for specific events, and allow them to access only specific spaces, like your public lobby or rooftop deck, through Spaceflow’s native functionality and integrations with outside access control tools like Salto KS.

Conclusions

In this article we’ve shared just a few ESG strategies that leverage the unique community-oriented nature of coliving to drive better outcomes for people and planet. There is no one right way to set up a property ESG plan but there is a growing body of resources out there to help operators and managers make the right choices when it comes to furthering Environmental, Social, and Governance goals.

Keep learning about ESG in shared living

You can read about other ways to integrate ESG into shared living by exploring the following:

- How to Embed ESG and Social Value into your Shared Living Business [webinar]: This webinar is designed to help you to get started on your impact journey, and feel grounded in how to think about ESG & social value in relation to your shared living business.

- ESG in Shared Living and Hybrid Hospitality: Now, a “Must Have” [podcast episode]: Episode 4 of the Coliving Conversations podcast features an insightful conversation with Amber Westerborg, Director of Sustainability & Impact at The Social Hub. Listen to learn all about how ESG is transforming investment and development in the shared living sector.

This article has been coauthored for you by:

Logan is Spaceflow’s Content Specialist. He is a widely-cited PropTech expert with a background in multifamily investment and brokerage, and he has written real estate stories on both sides of the Atlantic. When he isn’t talking about buildings or ESG, you can find him headbanging to loud music, riding horses, or hiking in the desert.

Transformational Coach and facilitator. Trainer in mindfulness, sharing circles, and how to live and lead more consciously. Co-author of the Community Facilitation Handbook and the Coliving Apps & Tech Guide. Facilitates community engagement strategies.